November: NASDAQ Composite Price Analysis

Author: Michael Stern

Last Updated: 20 November 2022

2022 is considerably a dismal year for tech stocks. This leads the stock market lower. What’s more, NASDAQ Composite even reached the critical support area, making investors more meticulous.

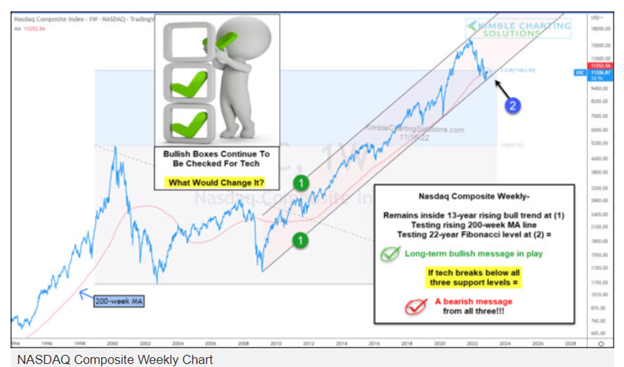

The index trades within the rising trend channel that is marked by each 1. In late 2021, it hit the channel’s top and continuously fell. But the tech free-fall has recently hit triple support at 2. The rising trend line, the 2.618 Fibonacci price level, and the 100-week moving average marked that support. Check out the NASDAQ Composite weekly chart below:

Bouncing sharply higher and checking all three support boxes would help the tech to be bullish for stocks. But slipping below triple support at 2 can fade all the positives away. Then, a bear market is expected to march on.

Technical Analysis

On Thursday, NASDAQ Composite Index closed the session at 11,144.96, where it traded a total of more than 4.12 billion shares. The declining stocks caused advanced to reach a 1.61 to 1 ratio.

About 3000 decliners and 1858 advancers were present that day. Then, 31 stocks successfully reached the 52-week high, with 115 on the lows for the NASDAQ Stock Exchange.

Meanwhile:

- Dow Jones Index – closed down at .2% (-7.51 points)

- NASDAQ 100 Index – closed down at -.19% (-22.23 points

- Salesforce, Inc (CRM) – obtained the largest percent change down at -3.5%

- Cisco Systems, Inc. (CSCO) – obtained the largest percent change gain at 4.96%

When Federal Reserve officials beckoned a rate-hiking campaign for slowing inflation is not yet over, stocks fell while bond yields jumped.

Stocks rallied from lows obtained earlier as shares of networking equipment company Cisco Systems rose nearly 5%. It surpassed the fiscal first-quarter report expectation. It also issued upbeat guidance. Intel, Apple, and other tech stocks climbed as well.

According to James Bullard, president of St. Louis Federal Reserve, “the policy rate is not yet in a zone that may be considered sufficiently restrictive.”

He added, “the change in the monetary policy stance appears to have had only limited effects on observed inflation, but market pricing suggests disinflation is expected in 2023.”

On Wednesday, Esther George, president of Kansas City Fed, told the Wall Street Journal, “I’m looking at a labor market that is so tight, I don’t know how you continue to bring this level of inflation down without having some real slowing, and maybe we even have contraction in the economy to get there.”

Stocks that are susceptible to the recession were also S&P 500’s notable losers. The chief investment officer at UBS Global Wealth Management, Mark Haefele, wrote in a note that the cumulative impact of rate hikes this year and additional monetary tightening continuously signal recession risks. He also added that they continue believing on “macroeconomic preconditions for a sustainable rally—that interest rate cuts and a trough in growth and corporate earnings are on the horizon—are not yet in place.”

Investors are more focused on the Federal Reserve. They also alert on what the central bankers say regarding the rates and inflation. Because of Bullard’s comment associated with much bigger interest rate hike possibilities, the market turned volatile.

He said that inflation is still unacceptably high. So, he suggested that the key short-term interest rate of the Fed, which is at a range of 3.75%-5%, has to climb to 7%. He also noted that the rates must be at least 5%.

Conclusion

As most investors expect higher interest rates, NASDAQ continuously closes lower. Stocks dropped while bond yields rose as Fed officials signaled the rate-hiking campaign dedicated to slowing inflation remains far from over.

FAQs

Different forces affect the NASDAQ 100 alongside the listed companies on it. Economic strength, trader sentiment, profit, and other factors can potentially move the market-capitalization-weighted index’s price.

The process of NASDAQ is to rank all eligible stocks for the index at the end of the month. Then, it adds stocks with the highest market values.

Currently, a company qualifying under the Market Value Standard should meet the listed securities of $75 million market value. It should also meet the $4 bid price for 90 consecutive trading days prior to application.

The main advantages for companies listing on the NASDAQ are lower minimum requirements and lower listing fees to qualify for the listing. The NASDAQ also features all-electronic trading, which is another advantage.

BWCEvent aspires to share balanced and credible details on cryptocurrency, finance, trading, and stocks. Yet, we refrain from giving financial suggestions, urging users to engage in personal research and meticulous verification.