- News

- Reviews

- Education

- Crypto Prices

- Crypto

- Price Prediction

- Bitcoin (BTC) Price Prediction

- Ethereum (ETH) Price Prediction

- Binance Coin (BNB) Price Prediction

- Dogecoin (DOGE) Price Prediction

- Floki Inu (FLOKI) Price Prediction

- Terra (LUNA) Price Prediction

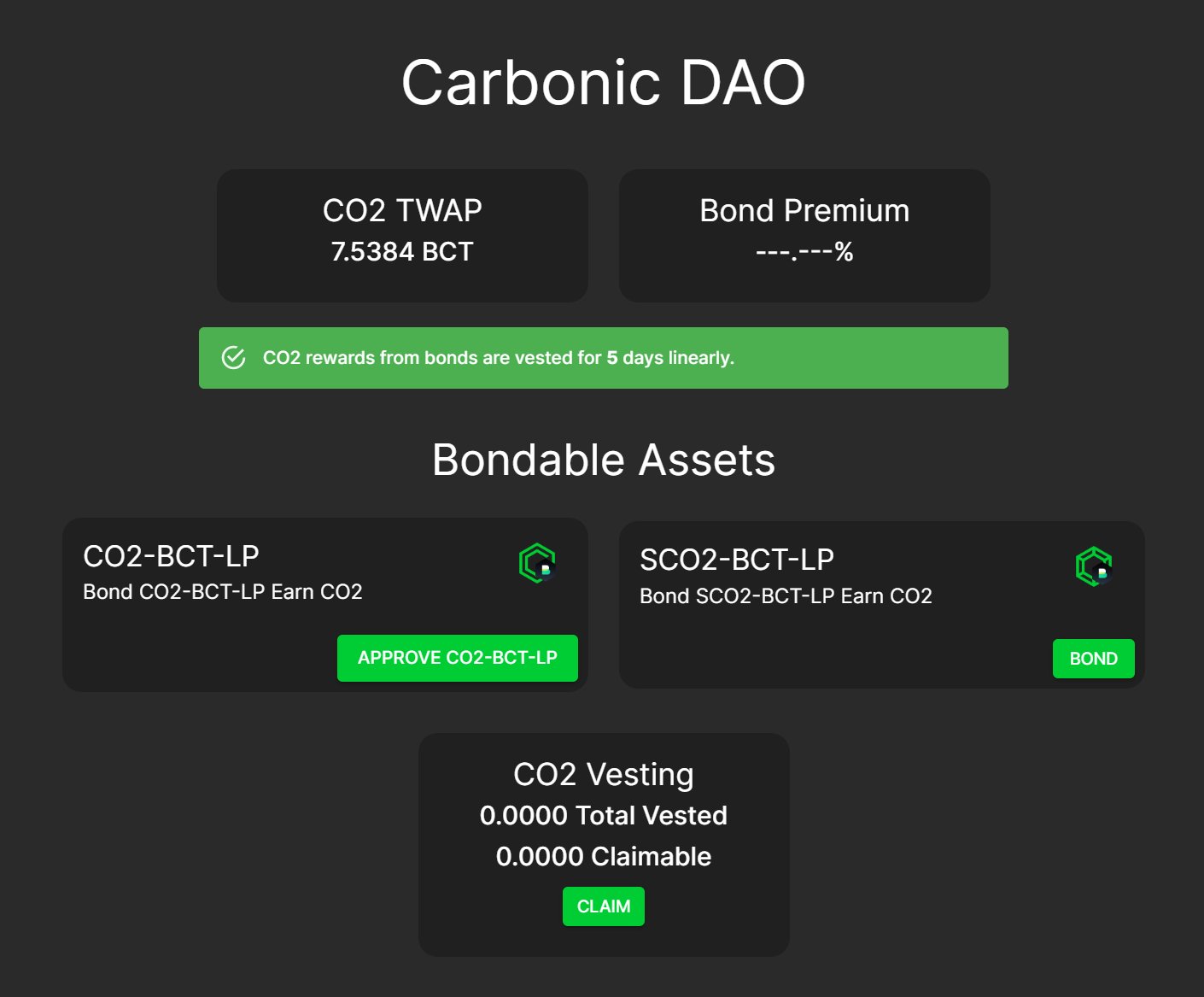

- Carbonic (C02) Price Prediction

- Meta World (METAD) Price Prediction

- Meta Course (COURSE) Price Prediction

- Ellipsis (EPX) Price Prediction

Brokers Reviews:

Crypto: