November: US Stock Market Technical Analysis

Author: Michael Stern

Last Updated: 20 November 2022

The inflation report on Tuesday boosted the equities, showing producer prices with an 8% increase in the 12 months through October versus the 8.3% estimated increase.

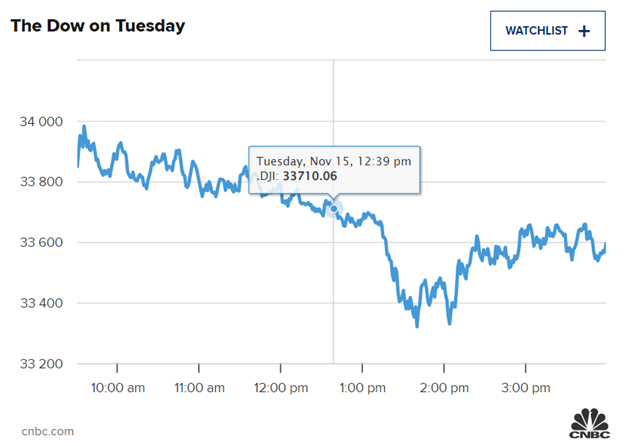

On Tuesday, it was confirmed that stocks had resumed the inflation-driven rally. This occurred after another report signaled a possible slow price increase. The tech-heavy Nasdaq Composite advanced 1.45% to 11,358.41, the S&P 500 gained 0.87% to close at 3,991.73. Then, the Dow Jones Industrial Average got 0.17% or 56.22 points at 33,592.92.

Technical Analysis

The main indexes of Wall Street ended up shaking off the Russian missile’s unconfirmed report of crossing into Poland, sparking volatility as investors grasped on softer-than-expected inflation data. The said data created high hopes of a pullback in US Federal Reserve rate hikes.

Because of the inflation report last Tuesday, there was an 8% rise in producer prices in the 12 months through October against the 8.3% estimated gain. Meanwhile, the consumer prices’ cooler-than-expected report kicked off the gains built on the rally late last week.

According to Chase Investment Counsel President Peter Tuz, “The market has been driven by the inflation number that came out a little bit lower than expected and confirmed last week’s number to some degree that we may have rounded the corner on inflation.”

He also added, “the market was “a little bit more volatile this afternoon as news stories came out about the Russian missile landing in Poland.”

After the producer price index, it was clear that the major averages rallied, showing a 0.2% increase for October against the 0.4% consensus increase estimate from Dow Jones. The report came after consumer price index data last week revealed inflationary pressure abating signs, which sparked a sharp rally.

Morgan Stanley’s Global Investment Office model portfolio construction head Mike Loewengart said, “The PPI read certainly adds more fuel to the fire for those who feel we may finally be on a downward inflation trend.” He added, “The market embraced last week’s consumer downtick and today’s initial reaction seems to be more of the same.”

Although the peak-inflation narrative obtains traction, the Fed pivot bar remains high. This is according to Baird investment strategy analyst Rod Mayfield. He also mentioned the possibility of trepidation at the central bank. That is due to their desire to prevent the mistakes that happened in the 1970s, like the stop-and-start policy that resulted in a longer inflation spell, and their credibility concerns. On the other hand, he added that “the crumbs are already being laid for a deceleration in the pace of tightening heading into 2023.”

Home Depot shares soared 16% after the results of the house improvement chain displayed it reached higher prices. That is to override a drop in the third quarter’s customer transactions.

In afternoon trading, The S&P and Dow momentarily dipped into the red after announcing higher crude oil prices. Later, the oil prices eased from highs.

Also, retail stocks lifted investor sentiment. Home Depot obtained strong results while maintaining guidance in place for 2022. Its share soared by 1.6%. Walmart shares rose after beating Wall Street revenue estimates and earnings and increased full-year guidance.

Mayfield stated, “Retail earnings are off to a pretty decent start, and could serve to reinforce the broader narrative of consumer resilience and labor market tightness. Earnings are critically important from here… the pace and breadth of the earnings deceleration (or re-acceleration) should determine the next leg for equities.”

Conclusion

In the last four for the third day, stocks ended higher while all major averages are expected to be on pace for monthly gains. The Nasdaq and S&P gained around 3.4% and 3.1%, respectively. The Dow gained 2.6% for November.

FAQs

Before making a US stock investment, you need to keep 5 things in mind: regulatory framework, charges, foreign exchange consideration, fund limit, and conclusion.

You can gain US stock exposure by investing in Exchange-Traded Funds (ETFs). You can consider direct or indirect routes. You can buy US ETFs via an international or domestic broker. You can also purchase Indian ETFs of international indices.

To own American company stocks, you do not need to be a US citizen. The US law regulates US investment securities, but there are no provisions that forbid people who are not US citizens from participating in the stock market.

BWCEvent aspires to share balanced and credible details on cryptocurrency, finance, trading, and stocks. Yet, we refrain from giving financial suggestions, urging users to engage in personal research and meticulous verification.