November: Asian Stocks Price Analysis

Author: Maria Andretti

Last Updated: 20 November 2022

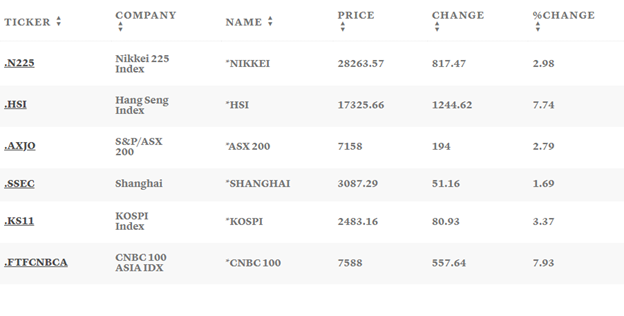

On Friday, most Asian stock markets rallied after the US inflation data speculated a less aggressive interest rate outlook, while China’s COVID pivot resulted in gains in the local markets. The authorities have shortened the inbound travelers’ and residents’ quarantine times. They have also scuffled a penalty on airlines that brought infected passengers in.

Although the Chinese government kept stricter COVID measures, facing its worst outbreak since May, the need to reduce the economic impact of the country’s strict zero-COVID policy was highlighted.

China’s Shanghai Composite index jumped 2.4%, while Shanghai Shenzhen CSI 300 index added 3.4%.

Hong Kong’s Hang Seng index was Asia’s best performer on Friday. It rallied over 7% after the government announced the minimizing of COVID-related movement curbs for both international travelers and residents.

The social media rumors regarding the possible change in the Chinese government’s stance towards the zero-COVID policy made the Chinese stocks surge in previous weeks. The said policy made the Chinese economic growth expected to halt before the year ends. It also significantly dented most investors’ sentiments toward the country, damaging its markets.

Technical Analysis

There were larger Asian stocks that rallied alongside the tech-heavy bourses that gained the most after the US inflation data discarded the expected rise of Federal Reserve interest rates at a slower pace in the following months.

For example:

India – Nifty 50 index rose 1.6%

Japan – Nikkei 225 index rose 3%

South Korea – KOSPI index rose 3.4%

Taiwan – Taiwan Weighted index rose 3.7%

Currently, markets are pricing more than 80% possibility that the Federal Reserve will increase the rates by smaller 50 basis points next month.

Strategist Frank Benzimra at Societe Generale SA said, “East Asia equities, more vulnerable to tighter US financial conditions could benefit more from US inflation peaking.”

“Some Asia central banks are at the end of their tightening cycle and could pivot before the Fed does,” he continues.

Since March 2020, most Asian stock benchmarks jumped due to China’s decision to ease some rules associated with flight bans, and quarantine caused a rally sparked by US inflation.

The MSCI Asia Pacific index rose to 5.1% on Friday, it’s back-to-back weekly gain since August. Hong Kong’s gauge of Chinese stocks surged over 8% following the authority’s decision to reduce the amount of contact close contacts and travelers should spend on quarantine.

SPI Assent Management’s managing partner Stephen Innes wrote in a note, “With peak Fed in the bag, thanks to a downside surprise in inflation data, pessimism at year-end around the earnings outlook could be offset by optimism on China, mainly if the country takes a less hardline stance on rising Covid cases,”

Australia & New Zealand Banking Group head of Asia research Khoon Goh pointed out that the Asian FX relief can be extended into year-end. It is because investors are getting more interested in the Santa rally. And considering some Asia assets were beaten down, the attractive valuations can greatly entice foreign inflows.

For Mizuho Bank chief Asia FX strategist Ken Cheung, the loosening COVI policy’s confirmation is a critical bullish RMB driver. It is because of the previous rumors while investors were not sure whether the government would delay the plan for reopening China in the middle of a recent case resurgence or not.

Conclusion

Signs of reopening in China and a more pacifist Fed were considered by Asian stock traders as two critical catalysts for the surge. The regional benchmark was currently down over 30% from its peak in February 2021. With the Chinese authorities’ moves alongside the nation’s top leaders’ meeting on Thursday, a more targeted approach is expected to tackle the outbreaks.

Yes. Asia became a core asset with excellent long-term growth characteristics. This is due to the pandemic’s better management and growth potential of the region.

Although it can be more difficult than buying domestic shares, buying stocks directly in foreign markets like China or India is possible. Investors have a chance to buy American Depository Receipts on US exchanges.

After the Federal Reserve caused fears of a potential recession, stating that the US interest rates were not finished to cool inflation, Asian stocks have sunk.

Opening a local brokerage account in a regional finance hub is the best way to purchase stocks throughout Asia.

BWCEvent aspires to share balanced and credible details on cryptocurrency, finance, trading, and stocks. Yet, we refrain from giving financial suggestions, urging users to engage in personal research and meticulous verification.